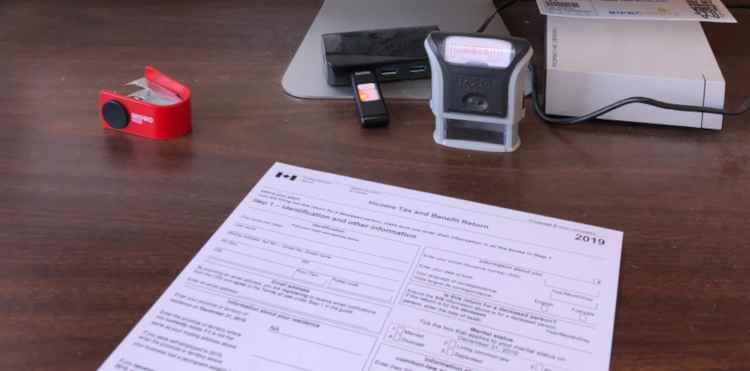

Tax Time is upon us and there have been a lot of changes in the forms this year!! So many in fact that CRA shut down their e-file transmissions in late January until February 24th to update their systems.

The “Authorize a Representative” has changed and now, for online access, the form must be submitted online either through the representative or the client. Form T1013 will be discontinued. If you already have a Representative on file with CRA not to worry, you will not have to re-authorize them.

Schedule 1 (Federal Tax Credit worksheet) is no longer. They have incorporated Schedule 1 into the “cover” which is now 8 pages…the longest it has ever been!

If a client has an authorized representative, and they pass away, CRA will now continue to work with the authorized representative. They will send the Executor a notice informing them of who they have as the Authorized Representative on file.

Other Canadian Tax Changes That Will Affect You This Year:

Canada Training Credit Limit – As of January 1, 2019, if you meet certain conditions, you will be able to accumulate $250 per year, to a maximum over your lifetime of $5,000, to be used in calculating your Canada Training Credit, a new refundable tax credit.

Canada Workers Benefit – For 2019, the Canada workers benefit (CWB) replaces and strengthens the working income tax benefit (WITB).

Income exempt under the Indian Act – A new section called “Indian Act – Exempt income” has been added to the Income Tax and Benefit Return, and a new form has been created.

Kinship Care Providers – For 2009 and later years, for the CWB and the former WITB, a care provider may be considered to be the parent of a child in their care, regardless of whether they receive financial assistance from a government under a kinship care program.

Home Buyers’ Plan – The maximum amount you can withdraw from your registered retirement savings plan (RRSP) under the Home Buyers’ Plan (HBP) increased from $25,000 to $35,000 for withdrawals made after March 19, 2019.

Medical Expenses Tax Credit – For expenses incurred after October 16, 2018, certain cannabis products purchased for a patient for medical purposes will be considered eligible medical expenses for the medical expense tax credit.

Donations and gifts – For donations made after March 18, 2019, in order to qualify for the enhanced tax incentives for donations of cultural property, the property no longer needs to be of national importance.

Allowances for members of legislative assemblies and certain municipal officers – For 2019 and later tax years, non-accountable allowances paid to elected members of legislative assemblies, certain municipal officers, and members of public or separate school boards are required to be fully included in income.

Zero-emission vehicles – If you are self-employed or claiming employment expenses, you may be able to claim capital cost allowance on zero-emission vehicles. Starting in 2019, there is a temporary enhanced first-year capital cost allowance of 100% for eligible zero-emission vehicles.

Canadian Tax Return Deadlines For 2020

Your 2019 tax return and payment are due on or before the following dates:

| Return Due: | Payment Due: | |

| Most People: | April 30th, 2020 | April 30th, 2020 |

| Self-Employed Persons (And their spouse or common-law partner) |

June 15th, 2020 | April 30th, 2020 |

What if you are missing information?

File your return on time even if you do not have all of your slips or receipts. You are responsible for reporting your income from all sources to avoid any penalties and interest that may be charged. If you have not received your slip by early or you know you won’t be able to get a missing information slip by the due date, I may be able to go online and see if a slip has been processed by CRA or we can use your pay stubs or statements to estimate your income and any related deductions and credits you can claim.

Did you know…

Even if you are filing your return electronically, keep your supporting documents for six years in case the CRA selects your return for review. Also, keep a copy of your return, the related notice of assessment, and any notice of reassessment in a safe place. I will send you an electronic copy of your complete return in a “Sync” File and suggest you keep electronic copies of all other documents in there as well.